Soft drinks firms set out the trends to stay aware of in the energy category

WHETHER it’s for the daily commute or getting those final assignments over the finish line, consumers are always looking to where they can pick up their next energy drink.

This means big business for the convenience sector, with Sport and Energy drinks sitting as a top three category in the channel with a total UK sales value of £817.9million, according to IRI data for symbols and independents.

Therefore, it remains important to keep on top of consumer trends across the category to make sure that Scottish c-store retailers can really make the most of this lucrative sector.

It’s with this in mind that Boost Drinks has launched a tranche of NPD across its portfolio of drinks as Adrian Hipkiss, marketing director at Boost Drinks, explained the benefit of a varied selection of energy drinks.

He said: “To boost this growth even further, flavours in energy now account for 38% of stimulation sales and have seen a huge 48% growth year-on-year, showing that there’s a significant thirst for a range of flavour variants to suit all tastes.”

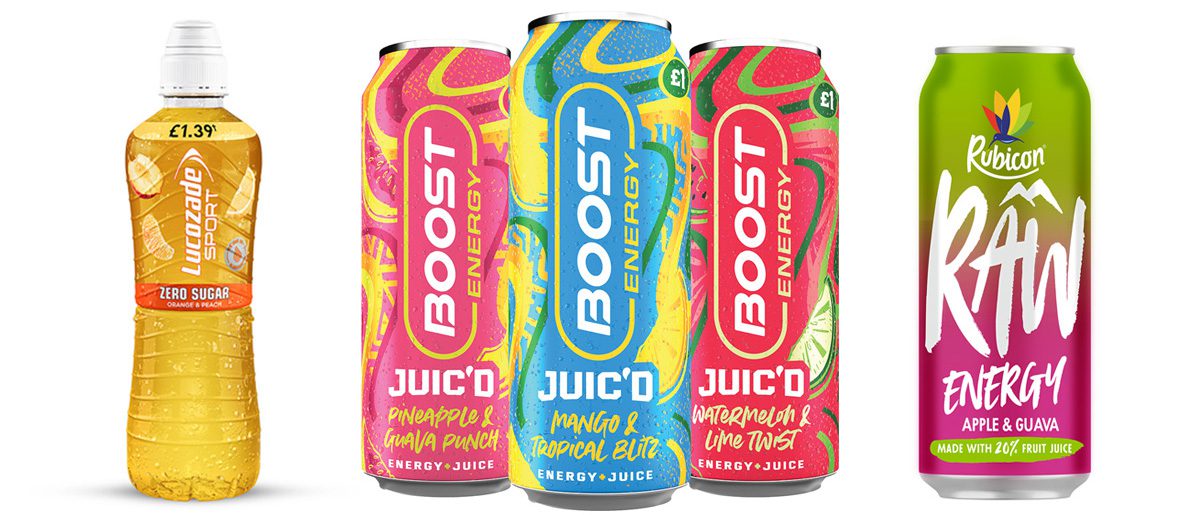

The first of this NPD kicked off in March with the reformulation of Boost Drinks Lemon & Lime 250ml Energy, formerly known as Citrus Zing, to capitalise on demand for citrus flavours.

On top of this, Boost launched its new limited-variant Raspberry and Mango Sport this month and looks to the summer for its new addition to the Juic’d range with Blood Orange & Raspberry Crush Juic’d, aiming to bring in some extra sales through bigger formats.

Hipkiss said: “Now more than ever, sales of 500ml cans are booming, with 16% growth year-on-year and 18% growth in the category from flavoured 500ml variants alone, resulting in the segment currently being the fastest-growing category in energy drinks.

“This growth and consumer appetite presents a promising opportunity for Boost Drinks to penetrate the 500ml market with a range such as Juic’d at an impactful, affordable price point.”

And it’s not just Boost that’s keen to make the most of this big can energy, as Barr Soft Drinks is banking on the larger format with both Rubicon Raw and Irn-Bru Energy.

Adrian Troy, marketing director at Barr Soft Drinks, said: “Big can energy plays an important role in the category, driving growth of 22%.

“It delivers against many consumer needs – shoppers see it as better value, the range of flavours in big can tick the box for those looking for taste and refreshment and, of course, the bigger the can, the bigger the boost.”

Troy reckons this big can energy will hold both brands in an attractive light across convenience and with Rubicon Raw set for another boost in marketing this year, its variants could be ideal for c-store chillers.

Troy said: “In addition, 2023 will also see the continuation of Rubicon Raw’s partnership with Boardmasters as the official energy drink partner.

“This includes exclusive pouring behind all festival bars, two huge experiential activations and handing out over 50,000 samples to festival-goers. The levy-free, HFSS-compliant range includes four 500ml big can energy drinks – Raspberry & Blueberry, Orange & Mango, Cherry & Pomegranate and, the latest addition, Apple & Guava.”

Health credentials such as the HFSS regulations mentioned by Troy remain important, too, with low and no sugar variants big money across soft drinks.

This should be no different for energy drinks, either, as Suntory Beverage & Food (SBF) seeks to capitalise on this with its new Lucozade Sport Zero Sugar variant.

The new launch comes in both Orange & Peach and Raspberry & Passion Fruit variants as SBF looks to make the most of the health kick.

Matt Gouldsmith, channel director for wholesale at SBF GB&I, said: “We’ve been seeing a long-term trend towards drinks with lower sugar, with 57% of shopper making or considering diet changes to make healthier choices.

“The low or no-calorie segments continue to outperform regular soft drinks, with almost 70% of total soft drink sales.

“We advise retailers to stock up on lower sugar drinks such as Lucozade Zero, which is seeing recent year-on-year growth of 58.5%, to make the most of this ongoing trend.”