When it comes to ready-to-drink beer and cocktails, convenience has the edge

each of WKD Blue, Red, Iron Brew and Green, plus two bottles of limited-edition WKD Brazilian. The new graphics say ‘just add mates’.

THE term ‘cocktail party’ may still carry connotations of wealthy socialites in the 1920s, but for Scotland’s young adults – and the retailers who serve them – there’s a developing trend that may be changing things.

“The emergence of the popularity of the RTD cocktail is probably one of the biggest drinks trends we’ve seen amongst young adult consumers in recent years,” said Debs Carter, marketing director – alcohol at SHS Drinks, which markets the top-selling ready-to-drink range WKD.

RTDs are still considered as drinks in their own right, but many people are now using them as a cocktail ingredient, she explained.

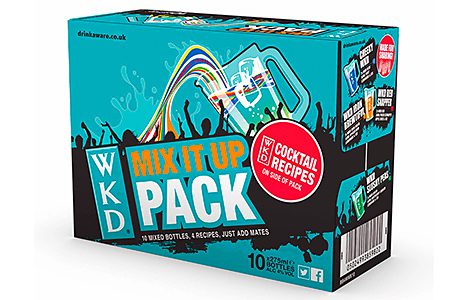

In response SHS Drinks recently launched the 10 x 275ml ‘Mix It Up’ cocktail-themed pack.

With four WKD cocktail recipes printed on the outside of the pack, the design is intended to bring WKD cocktails to life in the off-trade. The first production run of the new pack also contained a free cocktail recipe booklet including a £1 voucher off a future purchase. The pack contains 10 bottles and five flavours, including this year’s limited-edition WKD Brazilian.

With the winter party season just ahead, SHS Drinks says it expects the pack to do well. However, an aspect of consumer behaviour, linked to one technique of convenience retailing, could give c-stores an edge over competitors.

“Young adults have a spontaneous approach to social arrangements so rely heavily on convenience stores,” said Carter. “The availability of chilled RTDs is absolutely essential if retailers want to maximise sales to students and young adults.

“Providing chilled stock is a key way for independents to meet the needs of these purchasers and offer something not widely available in multiple grocers.”

• Craig Clarkson, category and trade marketing director – off trade, for Heineken UK, agrees.

“It may sound obvious, however the most important factor in helping to drive purchases of cider and beer, is ensuring that the products are kept chilled,” he said.

“Research has shown that 80% of convenience shoppers buying cider and beer will consume their purchase within two hours of picking it up.

“Heineken research also revealed that a fifth of lager buyers and a quarter of cider buyers are willing to pay more for a chilled product.”

Heineken’s latest innovations to target the young adult market are Desperados Verde and Old Mout cider.

Desperados Verde is a bottled lager flavoured with tequila and a twist of mint and lime, developed to appeal to 18-34 year-olds.

Old Mout, a premium fruit and cider combination originally created in New Zealand, was launched in the UK to appeal to young adult drinkers with an interest in world ciders.

Clarkson said: “This is a direct response to the increasing number of young adult drinkers who are not only looking towards flavour experimentation, but that also have a thirst for discovery.”

• Malibu is extending its pre-mixed can range with the addition of a new Mango flavour.

Pernod Ricard UK reports the introduction of pre-mixed cans has delivered substantial growth for the Malibu brand – the established flavours sell 7.3m cans a year.

Total value created by Malibu cans has been £8.2m to date and this summer, the new Malibu eight-can multipacks achieved week-on-week sales increases of over 56%.

The new flavour, available in wholesale and grocery channels has an RRP of £1.99.