Coca-Cola Europacific Partners reckons it can meet shoppers’ demands on soft drinks

HEALTHIER choices have been a priority for consumers for some time, so retailers should stock up on low and zero-sugar soft drinks, reckons Coca-Cola Europacific Partners (CCEP).

Amy Burgess, CCEP senior trade communications manager, highlighted a raft of Nielsen data that shows the importance of the drinks giant’s offerings.

She pointed out Coca-Cola Zero Sugar was the fastest-growing major cola brand by value and volume, while Diet Coke was worth more than £500million in GB retail.

Burgess also highlighted CCEP’s range of flavoured Coca-Cola Zero Sugar variants, including Cherry, Vanilla and the recently launched Lemon.

Meanwhile, Nielsen stats show zero-sugar options are growing ahead of the total flavoured carbonates segment, so the likes of Fanta Zero, Sprite Zero and Dr Pepper Zerooo can help retailers drive soft drinks sales.

Burgess said: “We’re constantly investing in our brands to keep them relevant and give consumers more choice, with a focus on low and no-sugar options.”

The communications boss also urged retailers to tap into other fast growing categories such as RTD chilled coffee, with CCEP’s Costa Coffee RTD leading the charge and up 46% in value in convenience.

She concluded: “Stocking sharing packs of soft drinks alongside meals and snacks can help shoppers grab everything they need for a summer barbecue or picnic.

“Almost a third of soft drink shoppers in convenience are on a food-to-go mission, so displaying single cans and bottles in chillers next to sandwiches can drive incremental sales.”

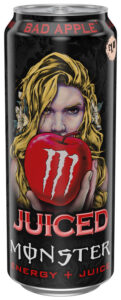

Monster leads the charge in energy drinks

ENERGY drinks continue to increase in popularity and are now worth £1.95billion in GB and growing, according to Nielsen, thanks to the arrival of new flavours, functionality and zero-sugar options.

With innovation key to increasing sales, CCEP senior trade communications manager Amy Burgess says retailers must stock up on the latest launches that are going to capture consumers’ attention.

She said: “Our Monster brand is leading the way when it comes to innovation in energy.

“NIQ statistics show 60% of NPD energy drink sales over the past year have come from Monster. Since the start of 2024, we’ve grown our range with the launch of Monster Reserve Orange Dreamsicle and Monster Juiced Bad Apple.”

But despite the emergence of new innovations, traditional energy drinks still remain popular, with Monster Original remaining CCEP’s flagship offering – being worth £126.6million in retail, according to Nielsen findings.

Burgess added: “This underscores the importance of maintaining a robust core product range alongside stocking new launches.”