Compliance essential as contributions increase

[box style=”0″]

By Darren Ryder. Darren is the director of automatic enrolment at work-based pensions authority The Pension Regulator

[/box]

AS a result of automatic enrolment, around 9.5 million people are now saving into a workplace pension and more than one million employers have successfully met their statutory duties.

We’ve moved from a situation where workplace saving was falling to one where staff now expect a pension. Around 80% of staff are now saving into a workplace pension.

Automatic enrolment is now business as usual for employers who are set up to pay pension contributions every month and to put new staff straight into a pension scheme.

• Increases to minimum pensions contributions.

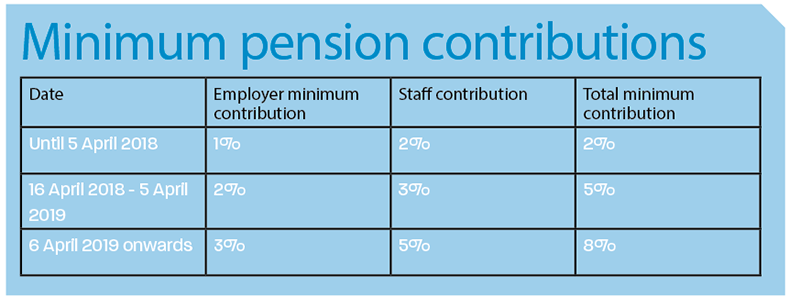

Last month on 6 April, the minimum pension contributions increased from a total of 2% of the worker’s salary to 5%. It will move again in 2019 to 8%.

We have written to employers to tell them about this. Employers should by now have made some simple checks with their payroll and pension providers to ensure they are paying the correct contributions.

More information on what employers need to do is available from The Pension Regulator website.

Any employer who fails to make the minimum contributions to the pension scheme will need to back date their payments so that staff do not miss out on the pensions they are entitled to.

Many payroll providers have automated their software so that contributions are increased automatically and employers who were already paying above the increased total minimum amounts will not need to take any further action.

Any employer who fails to make the minimum contributions will need to back date their payments to staff.

Of course, staff and employers also have the opportunity to increase their contributions above the minimum so that staff are saving even more.

Pension schemes will have been informing staff about the changes and while employers don’t have a legal duty to tell their staff about the increase to contributions, we are recommending that they do.

We’re helping employers tell their staff about the changes so they can highlight to them the advantages of workplace saving.

To help employers communicate with their staff, we have an online template letter www.tpr.gov.uk/ae-increase for them to pass to staff. The letters explain what is happening and about the benefits of workplace saving.

Automatic enrolment has changed the savings culture and Government, The Pensions Regulator and the pensions industry will be keeping a close eye on what happens next. Increasing contributions is an important part of boosting retirement outcomes and we want to make sure we build on the momentum already achieved.

• Compliance.

The majority of employers are successfully meeting their legal duties and compliance remains in the high nineties.

We want to help employers comply with the law, including maintaining the correct pension contributions, but we will use our powers where employers are deliberately failing to meet their duties.

So far the signs are good. Research has shown that before the increase, 35% of employers were contributing above the current minimum of 2% to at least some of their staff.

Most employers want to do the right thing for their staff and we’ll be checking to ensure they continue to do that as contributions increase.

The recent joint Department for Work and Pensions/ TPR advertising campaign encourages staff to get to know their pension. We want staff to appreciate the benefits of saving today, for later in life.