The biggest-selling lines such as wrapped breads are staple items, which act as key everyday essentials that play a crucial role in just about every convenience store.

And beyond those lines there are traditional morning goods, many of which turn out to be particularly important in Scotland, and an increasing number of world breads and newly developed sandwich alternatives, low calorie items and bakery products in the fast-developing free-from sector.

So how is the market doing at present and are there any special Scottish characteristics that retailers should be aware of if they want to play to the market’s natural strengths?

Amanda Brown, strategic insight director – Scotland with retail and consumer analysis firm Kantar Worldpanel explained that Scottish shoppers account for more of the overall GB bread and bakery market than would be suggested by our share of the population but that sales have been under pressure in recent times.

The GB take home bakery category was worth £3.9bn in the year to 26 May 2016, she said.

In Scotland, which currently has about 8.5% of the GB population the category is now worth £392 million or more or less dead on 10% of sales.

However, that Scottish sales figure is down 1.5% on the previous year.

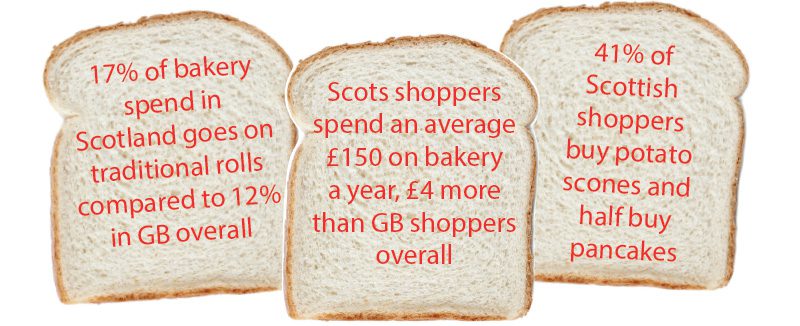

Scottish shoppers on average make 95 trips to buy bakery products each year, that’s nine more than the GB average shopper. In terms of category spend over the course of the year, Scottish shoppers spend £150, which is £4 more than the average GB shopper.

However, while Scots are, in many other product categories, more inclined than the GB average to buy brands that isn’t the case in wrapped bread.

North of the border sales of own-label wrapped bread take 17.6% compared to just 16.5% in GB overall.

Although standard wrapped bread remains clearly the biggest sector, accounting for 34% of spend, Scottish shoppers do differ when it comes to traditional rolls which account for 17% of spend in Scotland compared to 12% across GB.

Potato scones and pancakes also have a greater reach among shoppers in Scotland with 41% of Scottish shoppers buying potato scones and around half of all shoppers buying pancakes.

Within wrapped bread almost all types are in decline, the exception being smaller packs of half & half and wholemeal. In the last year in Scotland there has been growth in sales of tortilla wraps, bagels, flat breads, malt/fruit loaves as well as potato cakes and soda farls.