More players are entering the electronic cigarettes market and new developments are increasingly frequent

ELECTRONIC cigarettes have provided one of the fastest-growing categories in c-store retailing in recent years. There have been many apparent benefits – good profit margins and the promise of repeat business being among the most obvious.

But, as with many suddenly popular categories, new players appear and change happens fast.

So what are some of the current market trends and commercial and political developments and how can retailers, especially independents and local stores, ensure they continue to get the most out of the e-cigarettes opportunity.

Some of the biggest changes may come about as a result of the activities of the law makers.

As we summarise in the panel on page 88, UK regulatory bodies and the European Parliament have been busy making decisions that will change the nature of the products in the market and will also alter the way e-cigarettes and associated products are sold. But it’s likely to be more than a year before products and retailers have to meet new requirements.

The Westminster government has moved to ban sales to under-18s in England but that’s something that’s already actively supported by most manufacturers and practised by responsible retailers.

But in commercial terms important changes are taking place too.

Some of the big boys have entered the market including subsidiaries of large tobacco companies like BAT.

Pharmacy giant Boots is said to be about to start selling one range of e-cigarette products, a move that could contribute to growing acceptance of vaping, as e-cigarette use is often called.

At the same time a host of independent companies have been bringing out new products, everything from a mini e-cigarette line to a product infused with energy-providing taurine.

Earlier this year wholesaler Batley’s told Scottish Grocer that market was indeed one that is growing and diversifying and that meant it was one which would bring retailers rewards but would also need active management

It has a dedicated e-cigarettes area in the tobacco room in each depot and sells a wide range of e-cigs and accessories including cartomisers, starter kits, disposable e-cigarettes and chargers.

Sales in Scotland of e-cigarettes in 2013 grew by more than 500%, the firm said. One distinct trend was that consumers and retailers had begun to look for more variety and it had moved to stock additional lines.

Its sales of established brand Nicolites this year have increased by almost 4000% while the other brands have added significantly to the business.

Its top sellers in 2013 included starter kits and cartomisers from Skycig and Nicolites. Among disposables products the E-Lites brand had provided one of the best-selling lines with its E-Lites Red pack.

It reckons retailers should be ready to stock products beyond starter kits and disposables as it sees the market beginning to mature. Many consumers are beyond the trial stage and are moving onto rechargeables, it reckons.

The firm reckons the British e-cigarette market could be worth £400m in 2015. C-stores are perfectly placed to benefit and e-cigarettes could help reduce any negative effect on turnover of the tobacco display ban that’s due to come in April 2015, it suggests.

The Batley’s suggestion that retailers should stock refillable kits and new flavours could be seen to predict some of the developments that appear imminent in the category.

For example, as the story in the panel on page 90 details, e-cigarette brand Vapestick is currently launching a whole new system that combines refillable items and a collection of flavours in the V-Liquid range.

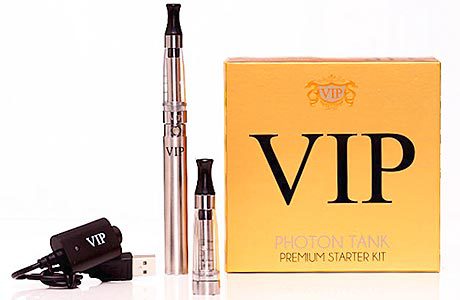

And another brand VIP, which launched in retail last year already offers such a kit with its Photon Protank series.

Lynne White, head of retail distribution for VIP told Scottish Grocer: “The electronic cigarette category is continuing to evolve and sales are increasing at a rapid pace with an estimated 1.3m users.

“The market has been mostly driven by customer demand for a product which offers an alternative to smoking traditional cigarettes.

“According to predictions within the industry, sales of electronic cigarettes are expected to reach £250m in the UK in 2014. The obvious benefit for independent retailers lies in a new revenue stream, which is becoming increasingly important as further restrictions on traditional cigarettes begin to impact their bottom line. Our target consumers are actively seeking a safer alternative to smoking, and our advice to retailers is to ensure that electronic cigarettes are positioned at till points or near tobacco products.”

Jac Vapour is another established e-cigarette player that reckons that as vapers become more confident in e-cigarette use they may be more inclined to use refillable systems.

Company co-founder and communications director Emma Logan said: “We have seen a move from the ‘cig-alike’ battery being the most popular battery style to our VGO range of products, that is a larger battery, designed to last the user for most of day and a larger refillable tank that allows the user to use their favourite flavour of e-liquid.

“We do not offer a disposable product – we leave those to competitors to offer in convenience stores, and they absolutely have their place for the absolute beginner. However, our products are for people who already know they want to invest in vaping and most have read consumer reviews that have led them to us.

“We have dedicated, approved wholesalers who sell, and use, our products within their retail outlets in towns and cities up and down the UK.

“As the market matures, customers realise that they do not need to simply replace their cigarette habit with a similar tasting and looking device. E-cigarettes are predominantly pieces of technology and customers want, and deserve, the best performance possible out of their batteries, tanks and accessories.

“Similarly, once a smoker has transitioned to a ‘vaper’ they start to regain their taste of smell and taste and may realise that their previously enjoyed favourite tobacco flavour (chosen to mimic their favoured cigarette brand) is no longer as delicious as it once was – over time, users may crave sweeter flavours. Two of our biggest sellers are Strawberry Chew and Banana Milkshake.”

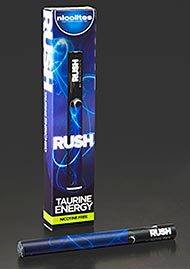

Of course, many providers have offered flavoured e-cigarettes for some time, but Nicolites figures it now has an e-cigarette product with a WOW factor

Rush, launched by Nicolites for 2014, is enriched with taurine, the substance used in stimulation drinks like Red Bull.

It’s a 400-puff disposable e-cigarette costing £6.95 which is available with or without nicotine (11g) and has a white LED tip, which the firm says makes it easier to identify as an e-cigarette when used indoors in public places.

It’s designed to give a stimulating rush when inhaled, thanks to the taurine.